Financial Planning to Get the Most Out of Life

Now and In the Future.

Straightforward Personal Financial Services

Financial Planning to Get the Most Out of Life Now and In the Future.

Straightforward Personal Financial Services

Are you planning to do what you want with your money (now and later), or is it going to keep slipping through the cracks?

Managing money can be a mystery. You work hard, take care of your family, and do your best to enjoy life, but money always plays a role in the enjoyment part. Without a clear, understandable plan in place your money has a way of disappearing.

And the “future” has a way of sneaking up on us before we’re ready.

Are You Worried About:

● Not being able to enjoy life because of stress around money.

● Losing money to tax surprises.

● Not being financially prepared for retirement.

● Missing out on investment opportunities.

● Struggling to understand how to manage your money.

Take control of your finances and enjoy more of life, now and in the future.

Are you planning to do what you want with your money (now and later), or is it going to keep slipping through the cracks?

Managing money can be a mystery. You work hard, take care of your family, and do your best to enjoy life, but money always plays a role in the enjoyment part. Without a clear, understandable plan in place your money has a way of disappearing.

And the “future” has a way of sneaking up on us before we’re ready.

Are You Worried About:

● Not being able to enjoy life because of stress around money.

● Losing money to tax surprises.

● Not being financially prepared for retirement.

● Missing out on investment opportunities.

● Struggling to understand how to manage your money.

Take control of your finances and enjoy more of life, now and in the future.

Straightforward Individual Financial Services

Personalized Financial Planning and Investment Management

that you can trust and understand.

Financial Planning | Investing | On-Demand Advice | Lockheed Martin Help

Get the most out of life and with personal and family

Financial Planning

Review and advise on your entire financial situation, including:

● Cash Flows

● Your short-term and long-term tax saving opportunities

● Employee benefits like your 401(k), pension, and Health Insurance

● Budget

● Debts / Debt Payments

● Other Investments

● Real estate properties

● Wills, trusts, and beneficiary situations

We’ll walk you through opportunities in your near or distant future, such as:

● Paying for your child’s education

● How to turn your investments into an income

stream after you’re done working

● Buying a home, buying a bigger home, or

downsizing your home.

● Social Security: What to expect, navigating

complicated situations like Teacher Retirement,

and when to start Social Security benefits.

● Complex estate planning and asset protection

strategies.

What do you want to do in life? We’ll help create a plan to help you visualize and

accomplish any financial goal. Some ideas might be:

● Start a business

● Retire early

● Take more big trips

Plan for Today, Tomorrow, and Retirement with

Investment Management

*Available to all clients. Not required for other services. No investment minimums.

Plan to live the life you want now:

● Tax saving investment strategies to help save taxes now, and over the long-term.

● Short-Term Investments

● Setting Up Different Financial Accounts

● Budgeting to Allocate for Investments

● Set Up Automatic Investments

Plan to live the life you want later:

● Retirement Investment Planning

● 401(k), Pension, and other Retirement Income

● Investing in Your Child’s Education

● Long-Term & Retirement Distribution Tax Planning

● Retirement Withdrawal Planning: Increase and

Decrease Retirement Withdrawals to Adjust for

Your Life.

Get investment advice that is always straightforward and simple.

We will never use any financial products that tie your money up.

Assets Under Management |

Annual Advisory Fee |

$0 – $1,000,000 |

0.60% |

$1,000,001 – $10,000,000 |

0.45% |

$10,000,001 and Above |

0.35% |

*No investment minimums.

Financial help is always a call away with

On-Demand Advice

Save time solving complicated financial issues with expert advice an hour at a time.

● Financial Advice

● Tax Advice

● Business Advice

● Investment/Retirement Advice

Just schedule a time that fits into your busy schedule and get the advice you need quickly.

Understand and manage your complicated VP and Director Benefits for

Lockheed Martin

LTIs, LTIPs, RSUs, NQSSP, deferring MICP

If you’re a VP or Director at Lockheed Martin, understanding how all the benefits work

and interact can be a challenge. I’ll walk you through every option and help you make

confident, informed decisions. Then I’ll advise 2 – 4 times a year on the best decisions

to make with your benefits, specific to your situation and plan.

*Everything in the “Financial Planning” service is included in this service as well.

Straightforward Individual Financial Services

Personalized Financial Planning and Investment Management That You Can Trust & Understand.

Financial Planning

Get the most out of life and with personal and family

Financial Planning

Review and advise on your entire financial situation, including:

● Cash Flows

● Your short-term and long-term tax saving

opportunities

● Employee benefits like your 401(k), pension, and Health Insurance

● Budget

● Debts / Debt Payments

● Other Investments

● Real estate properties

● Wills, trusts, and beneficiary situations

We’ll walk you through opportunities in your near or distant future, such as:

● Paying for your child’s education

● How to turn your investments into an income stream after you’re done working

● Buying a home, buying a bigger home, or downsizing your home.

● Social Security: What to expect, navigating complicated situations like Teacher Retirement, and when to start Social Security benefits.

● Complex estate planning and asset protection strategies.

What do you want to do in life? We’ll help create a plan to help you visualize and accomplish any financial goal. Some ideas might be:

Investment Management

Plan for Today, Tomorrow, and Retirement with

Investment Management

*Available to all clients. Not required for other services. No investment minimums.

Plan to live the life you want now:

● Tax savings strategies to help save taxes now, and in the long-term

● Short-Term Investments

● Setting Up Different Financial Accounts

● Budgeting to Allocate for Investments

● Set Up Automatic Investments

Plan to live the life you want later:

● Retirement Investment Planning

● 401(k), Pension, and other Retirement Income

● Investing in Your Child’s Education

● Long-Term & Retirement Tax Planning

● Retirement Withdrawal PLanning: Increase and Decrease Retirement Withdrawals to Adjust for Your Life.

Get investment advice that is always straightforward and simple.

We will never use any financial products that tie your money up.

Assets Under Management |

Annual Advisory Fee |

$0 – $1,000,000 |

0.60% |

$1,000,001 – $10,000,000 |

0.45% |

$10,000,001 and Above |

0.35% |

*No investment minimums.

Schedule a Call

On-Demand Advice

Financial help is always a call away with

On-Demand Advice

Save time solving complicated financial issues with expert advice an hour at a time.

● Financial Advice

● Tax Advice

● Business Advice

● Investment/Retirement Advice

Just schedule a time that fits into your busy schedule and get the advice you need quickly.

Lockheed Martin

Understand and manage your complicated VP and Director Benefits for

Lockheed Martin

LTIs, LTIPs, RSUs, NQSSP, deferring MICP

If you’re a VP or Director at Lockheed Martin, understanding how all the benefits work and interact can be a challenge. I’ll walk you through every option and help you make confident, informed decisions. Then I’ll advise 2 – 4 times a year on the best decisions to make with your benefits, specific to your situation and plan.

*Everything in the “Financial Planning” service is included in this service as well.

I get it – the days are long, but the years are short. You know you need a financial plan now (more like yesterday), but where do you start?

You don’t shy away from hard work. You’re building a life one day at a time, trying to prioritize family, grow a business, and enjoy some of the fruits of your labor. But it always seems to come down to money and the decisions you make with it every day. Sometimes, however, it’s decisions you didn’t make – missed opportunities now to create something great later in life, or even next month.

I know how you feel.

My parents were masters at their trade, but when it came to managing their personal finances, it was always somewhat of a mystery. Taxes, debt, income, investing, real estate, retirement – you want to provide for your family and live a good life, but you need more than a “hope” for the future. You

need a financial plan.

I‘d like to help.

Let’s make sure every hard-earned dollar translates to living the life you want now and in the future.

The Simple Path to a Financial Plan You can Trust:

1. Schedule a Call

Let’s talk about your personal finances, where you need help, and what it would look like to work together.

2. Get a Straightforward Plan

We’ll create a financial plan you can understand and trust and put your money to work building the life you want.

3. Enjoy Life with Confidence

Spend less time worrying about your money and more time enjoying life, family, and the things that matter most

The Simple Path to a Financial Plan You can Trust:

1. Schedule a Call

Let’s talk about your personal finances, where you need

help, and what it would look like to work together.

2. Get a Straightforward Plan

We’ll create a financial plan you can understand and trust and put your money to work building the life you want.

3. Enjoy Life with Confidence

Spend less time worrying about your money and more

time enjoying life, family, and the things that matter most.

AFFILIATIONS

Travis McCullough, CFP®, MST

Founder

Let’s put your money to work in the middle of your busy life.

I’m Travis McCullough, founder of Forthright Financial Services.

Straightforward, honest, direct. That’s what you deserve when it comes to managing your finances. With your busy life, that’s what you need.

The problem is most financial decisions can feel daunting, and the options are almost overwhelming. What should you do? What can you do? What about your family, your home, your kids?

You know you need a financial plan, especially when it comes to planning for the future. You can keep putting it off, but the future has a way way of getting here before you know it.

You can’t afford another year, another month, another day without a financial plan in place.

That’s why you need someone on your side who can simplify all the complicated financial stuff and help you make the best money decisions everyday. You’ve worked too hard to leave it up to chance.

With Financial Services from Forthright, you’ll be able to:

● Understand and prepare for your taxes, while avoiding surprises.

● Invest with confidence so your money works as hard as you do.

● Understand your cash flow and manage debt so you control your money.

● Follow a plan that gives you confidence about enjoying life now and after retirement.

And so much more.

Let’s put your money to work.

Schedule a call and get honest, straightforward financial services designed around your busy life.

Travis McCullough, CFP®, MST

Founder

Let’s put your money to work in the

middle of your busy life.

I’m Travis McCullough, founder of Forthright Financial Services.

Straightforward, honest, direct. That’s what you deserve when it comes to managing

your finances. With your busy life, that’s what you need.

The problem is most financial decisions can feel daunting, and the options are almost

overwhelming. What should you do? What can you do? What about your family, your

home, your kids?

You know you need a financial plan, especially when it comes to planning for the

future. You can keep putting it off, but the future has a way way of getting here before

you know it.

You can’t afford another year, another month, another day without a financial plan in

place.

That’s why you need someone on your side who can simplify all the complicated

financial stuff and help you make the best money decisions everyday. You’ve

worked too hard to leave it up to chance.

With Financial Services from Forthright, you’ll be able to:

● Understand and prepare for your taxes, while avoiding surprises.

● Invest with confidence so your money works as hard as you do.

● Understand your cash flow and manage debt so you control your money.

● Follow a plan that gives you confidence about enjoying life now and after

retirement.

And so much more.

Let’s put your money to work.

Schedule a call and get honest, straightforward financial services designed around

your busy life.

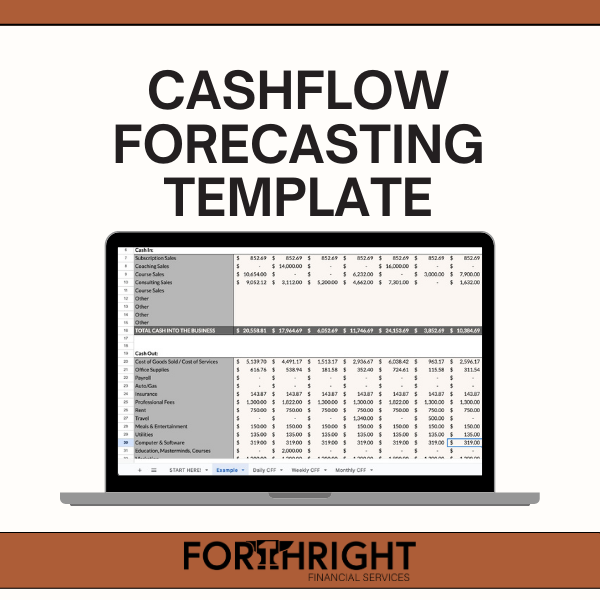

Cash Flow Forecasting Mini-Course and Template.

FREE ACCESS - LIMITED TIME ($149 Value!)

Mastering Cash Flow Forecasting: Comprehensive Guide for Business Owners

Start tracking your cashflow today with this simple to use template!

Included is the link to copy and download the spreadsheet template so you can get your forecast up and running ASAP.

Additionally there is a short tutorial that you can watch to get you more comfortable with using the template and to help with some thoughts around cash flow forecasting. This can be ESPECIALLY important if you are easily dismayed when your forecast is not PERFECT on the first go!

Read From Our Blog

Quick Links

Business Services

Personal Services

About

Contact Us

Forthright Financial Services (“FFS”) is a registered investment advisor offering advisory services in the State[s] of Texas and in other jurisdictions where exempt. Registration does not imply a certain level of skill or training.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Forthright Financial Services disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

FFS does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall FFS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if FFS or a FFS authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.